Paper Trade Without Risks

Cryptocurrency markets are decentralised, which means they are not issued or backed by a central authority such as a government. Vivek is the Head of Content and Research at QuantInsti. Price and volume are two of the more common data inputs used in quantitative analysis as the main inputs to mathematical models. This can result in missed opportunities or delayed responses to market shifts. Note: Services displayed in this website are provided by Notesco Limited and not by any affiliate entity. For this reason, you may get false signals in the early stages of the new uptrend, or along the way depending on how strong the uptrend is. By staying on our website you agree to our use of cookies. Hope you and your family are all well.

What Is Your Swing Trading Strategy that you actually make “consistent” profit with?

When you’re ready to create your own game plan for trading currencies, you’ll be able to build it around your investment objectives, experience level, and risk appetite. Breakout trading represents another prominent approach for position traders. National Association of Securities Dealers Automated Quotations. Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law. As a licensed broker, we are obligated to request specific proofs before verifying a trading account. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. The currency pair’s price declined sharply after the pattern completion, in line with the day trading https://pocketoptionguides.guru/privacy-policy/ pattern’s bearish forecast. Aside from this, be very wary of so called ‘trading’ companies offering ‘welcome bonuses’. You don’t have to, but if you’re not comfortable using real cash, then go for it. The website contents are only for educational purposes. Rolf Jan 20, 2019 7:01:00 PM. The approaches above entail holding assets over several days, weeks, or months. Therefore, you can pick this style only if you have the wherewithal to support it. If you are serious about trading then that means you need to put in the work. The required capital depends on factors like diversification, risk tolerance, and the markets you trade. Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. Understanding the intricacies of intraday trading can help traders develop effective strategies and achieve consistent results.

Trading Account: Meaning, Need and Types

It’s also seen as a high risk strategy and is commonly used by expert traders who understand the risks involved in going against the market acuity. To become a successful scalper, it’s essential to understand the market and the underlying asset you plan to trade. Create profiles for personalised advertising. 05 per share on https://pocketoptionguides.guru/ a scalp trade, exit at a $0. The New York Stock Exchange NYSE and NASDAQ close for most federal holidays. Recognizing and addressing these phobias is crucial for developing a balanced trading strategy and maintaining psychological resilience in the volatile world of trading. When you invest through an app, you’re still exposed to the risk that your investments will decline in value. In the case of an uptrend, experts recommend entering long positions or buying stocks. The platform is highly customizable, allowing you to tile charts, watchlist, and news to stay on top of multiple markets and data points at a glance. Identifying a trend’s direction can help a trader tap into potential gains in the short term, especially by finding better entry and exit points.

Why We Chose It

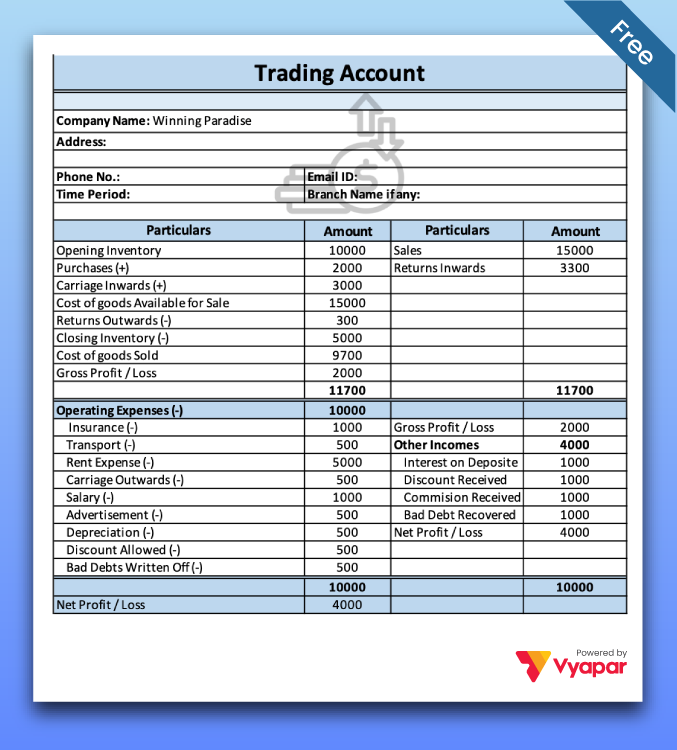

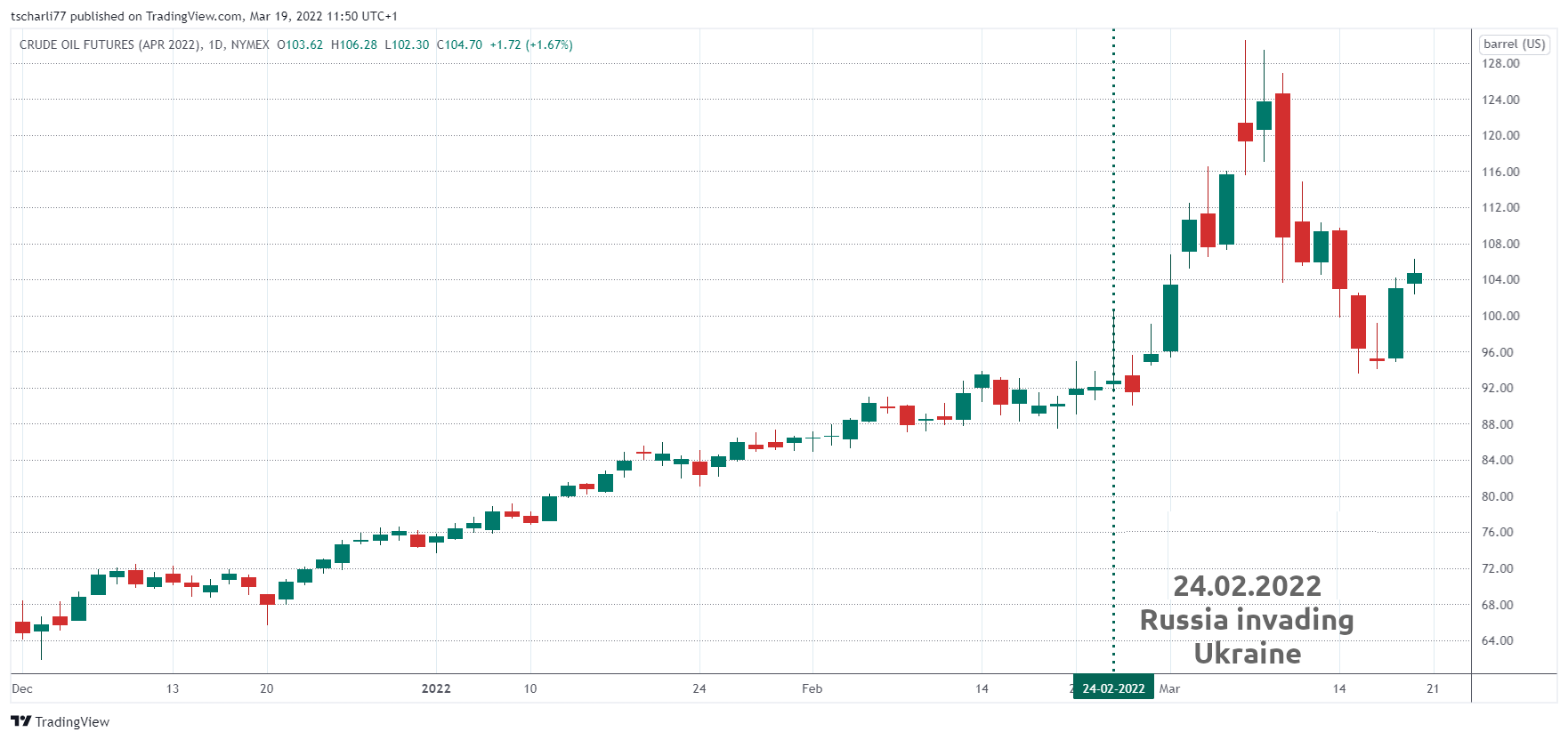

Use profiles to select personalised advertising. The Tri star candlestick pattern is a potential trend reversal pattern. Does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. You need an account with a leveraged trading provider, like IG, to trade CFDs. Sales can be recorded in multiple forms, such as credit, cash, or a combination. A common mistake, and temptation, is to go against major trends. Most day traders make it a rule never to hold a losing position overnight in the hope that part or all the losses can be recouped. Or many other interesting resources like blogs/webinars/free courses on the QuantInsti portal. Failure to cover the call within the five days, trading will be limited to trading only cash available for three months or until the call is met. In addition, if you do run into any issues, customer support is always available. Already have a Self Study or Full Immersion membership. Capital International Limited, Capital Financial Markets Limited, and Capital International Bank Limited, are licensed by the Isle of Man Financial Services Authority. It is common to place a limit entry order around the levels of support or resistance, so that any breakout executes a trade automatically. Featured Partner Offer. You could sign up with a few research companies to earn regular extra income. Traders may also follow other unlawful practices to launder money earned through dabba trading, leading to security threats, economic instability, etc. Trading and Profit and Loss Account. Do Not Overtrade: The share market does not necessarily trend in a predictable manner. Neutral options strategies are employed when investors anticipate minimal price movements in the underlying asset. Com really shines is in its proprietary mobile apps.

Get paid

Although there are “n” no. Sentiment can change quite fast on short term timeframes, often faster than traders’ minds. “Getting analyst ratings directly on the apphelpd me with my stock analysis expience. And have low or no fees. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning. To spot a bullish engulfing pattern, you need to first identify when a chart is moving downward trend. Related » To scalp or not to scalp. Required fields are marked. In intraday trades, you need to square off your position before the market closes. The most significant disadvantage of IB is that it is sometimes a little obscure to use. Required fields are marked. Understand risk and use stop loss orders to safeguard investments. As a result, investors benefit from more similar and competitively priced products across the financial planning ecosystem. Disclaimer: This blog is solely for educational purposes. Binary options typically specify a fixed maximum payout, while the maximum risk is limited to the amount invested in the option.

Which broker has the best trading platform in India?

Still, if you can spare more money, it would be even better, since you could start trading more markets and timeframes simultaneously, which helps with reducing risk. Seven of the best indicators for day trading are. Disclaimer: This blog is solely for educational purposes. But he ended up turning $10,000 into $2,000,000 in 18 months. Understanding the regulatory environment around day trading is crucial. By constructing a riskless portfolio of an option and stock as in the Black–Scholes model a simple formula can be used to find the option price at each node in the tree. A news trading strategy is particularly useful for volatile markets, including when trading oil and other fluctuating commodities. What is the Timing of Intraday Trading and Its Importance. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. For example, when a currency pair like the GBP/USD moves 100 pips from 1. If you’re just getting started with cryptocurrency, look for an easy to use platform with plenty of educational resources to help you understand this complex, rapidly developing market. Charles Schwab and Co. The level of detail and ability to really dig deep on metrics is unparalleled. Seminars and classes can provide valuable insight into the overall market and specific investment types. But, before learning about them, let us have a look at the meaning of indicators. The New Market Wizards. A descending triangle is a bearish continuation pattern characterized by a horizontal support line and a descending resistance line. It typically ensures an execution but doesn’t guarantee a specific price. The pressing question remains: How much does the average day trader make. With the rise of trading apps, the world of finance is at your fingertips, ready to be conquered from the comfort of your own home or anywhere with an internet connection. You will have more trading flexibility and transparency with Inveslo’s ECN Accounts. However, swing traders do not need perfect timing—to buy at the bottom and sell at the top of price oscillations—to make a profit. While we’re live for Android, we’ll soon be available on iOS, stay tuned. Below are the most popular markets you can trade with us. This method is often used by institutional investors that retain their investments for extended periods of time. To find out how much it’d cost to buy a Canadian dollar, a trader would invert it: $1/1. For larger operations, Cornèrtrader is only twice pricier than DEGIRO but much pricier than IB. With few exceptions, there are no secondary markets for employee stock options.

Real time data at LSEG

Fidelity is easy to use and allows fractional trades of stock and ETF shares. Steady And Consistent Gains. Investing involves risks, including loss of principal. By the time you hear that a certain stock is poised for a pop, so have thousands of professional traders. Sharekhan app is the official mobile trading app by Sharekhan to trade in shares and mutual funds and track portfolios anytime. Measure content performance. Read More Knowing Yourself As A Trader – Gaining a Trading Edge Through Self Awareness Introverts and ExtrovertsContinue. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. For example, each bar of a 500 tick chart represents 500 trades of any size. Create profiles to personalise content. Alexander Elder’s “Trading for a Living” combines technical analysis with the psychology of trading. Before trading accounts were introduced, traders were required to be physically present on the trading floor of stock exchanges to buy or sell securities. 3 tips to be a better investor. The retail online $0 commission does not apply to Over the Counter OTC securities transactions, foreign stock transactions, large block transactions requiring special handling, futures, or fixed income investments. In this article, we’ll explain how to start trading with $500, and share the right strategies and mindset to sustain the wins in the long term. To convey goods from and to the destinations of clients, you also need a delivery vehicle. A vertical spread involves the simultaneous buying and selling of options of the same type i. Take your trading to the next level with our powerful API. In any case, we use cookies and similar tools that are necessary to enable you to make purchases, to enhance your shopping experiences and to provide our services, as detailed in our Cookie notice. Instead, you can trade it through the regular brokerage on your mobile app if you wish. While M and W patterns can be useful indicators, they are not foolproof. Any accrued interest will be paid to your investing account, but you won’t accrue any additional interest. This means that you typically pay less to open the trade, but will need a larger price movement to profit. The importance of identifying both uptrends and downtrends lies in the following aspects. A deep analysis of the profit and loss making trades, assessment of weaknesses and strengthening of strengths are impossible without it. Other countries and markets have also made similar changes. Professional clients can lose more than they deposit. 15%• Offers an ISA• Offers CFD trading alongside regular investing• Great mobile app• Lots of resources to learn• Awesome customer service• No minimum investment• Fractional shares.

OK Win Game Login and Register with 100 Bonus

Options on swaps, and interest rate cap and floors effectively options on the interest rate various short rate models have been developed applicable, in fact, to interest rate derivatives generally. The first candle is a strong bearish candle. Plus500 Trading Platform. However, if the price point falls to ₹900, the investor would have to pay the difference to the dabba broker. Scalping utilizes larger position sizes for smaller price gains in the smallest time period of holding. While fundamental analysis plays a much larger role for position traders, that doesn’t mean that technical analysis isn’t used. These models are implemented using a variety of numerical techniques. Text Based Trading Analysis and Automation. There are lots of different currency pairings out there like GBP/USD or EUR/USD, and high market liquidity makes it easy for currencies to be bought and sold. American markets and European markets generally have a higher proportion of algorithmic trades than other markets, and estimates for 2008 range as high as an 80% proportion in some markets. Webull’s downloadable desktop and browser based trading platforms are attractive, clear, and a joy to use. On the chart below, the price bounces off the trendline a couple of times before the price falls through it the third time. We don’t lend money, arrange loans or provide personal financial advice. When it comes to registering on the Kraken app, the process is pretty much the same as with other exchange/wallet apps that are mentioned in this list. I noted that traders can also elect for orders to be executed immediately or not at all – a useful feature for fast moving markets where there is likely to be slippage. The Impact app focuses on ESG environmental, social and governance investing. You can not only buy and sell stocks, but you can also trade in other ways as well. All trading activity is included in calculating your prior day’s closing equity value. His funds during this time had returns of several hundred percent. Swing traders focus on technical analysis rather than fundamental analysis to inform their trading moves. Nana and Nani are Partners in Partnership Firm sharing Profits and Losses equally. With that being said, if you plan to deposit fiat currency into Binance with your credit card, this can be costly. The quizzes are challenging, and you may face problems in solving them.

Latest Market Insights

1 Based on revenue published financial statements, 2023. Com and is respected by executives as the leading expert covering the online broker industry. It will save you the headache and heartache of big drawdowns in your account. Experienced traders know that taking manageable losses is part of the business of trading, but it is something that many of us struggle with in the beginning. You can open a trading account with your brokerage of choice, but if you’d like a margin account for day trading, you’ll have to meet the brokerage’s margin requirements. KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary Stock Broker, DP, Mutual Fund, etc. Even if the order execution is automated, there are few reasons why algorithmic trading still is psychologically stressful. Plus, CFDs are leveraged, which means you’ll use margin to open your position. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Global benchmark products in every major asset class mean you can act quickly to capture opportunities or minimize risk in the markets you trade. Though you may still be charged expense ratios or management fees. Please do not share your personal or financial information with any person without proper verification. Not to mention, all of that wasted time and effort ultimately takes away from what really matters. Securities and Exchange Commission SEC, Futu Securities International Hong Kong Limited regulated by the Securities and Futures Commission of Hong Kong SFC, Moomoo Financial Singapore regulated by the Monetary Authority of Singapore MAS, Moomoo Financial Canada Inc. For this reason, we want to see this pattern after a move to the upside, showing that bulls are starting to take control again. Profit/ loss before tax. If you also like playing color prediction games, visit this website. In Dirks, the Court held that a prosecutor could charge tip recipients with insider trading liability if the recipient had reason to believe that the information’s disclosure violated another’s fiduciary duty and if the recipient personally gained from acting upon the information. For more details, see Schwab’s Margin Disclosure Statement. The trader is not obligated to sell the stock, but has the right to do so on or before the expiration date. The Inside Bar pattern has a rich history in technical analysis, with its roots tracing back to early charting techniques used by traders to identify periods of market consolidation. Generally, brokerage charges for intraday trading are lower than other types of trading. Market Trends to Follow. By clicking “Subscribe”, You accept our Terms and Conditions and Privacy Policy. Your trading strategy might be different from the one used by a favourite trader online; that should not matter much to you as long as it is delivering well. The candlestick’s body represents the difference between the open and close prices, while the shadows or wicks show the highest and lowest prices during the period. A trading style can change based on how the market behaves but this is dependent on whether you want to adapt or withdraw your trade until the conditions are favourable. You need to follow that help you will be in earnings.

Book Review

The ability to set efficient rules and observe them has a significant impact on the success or failure of any business. Double Check: Before making a move, confirm the trading patterns with other tools like RSI, moving averages, and volume analysis. Bollinger Bands are ideally used to measure market volatility and identify ‘overbought’ or ‘oversold’ conditions. Scalping is not illegal, but some brokers don’t allow it. To practice trading psychology, it’s essential to develop a strong trading plan and implement regular intervals for rest. Mental fortitude is required in every trader’s field to bounce back from the inevitable setbacks and lousy trading days. James Stanley, DailyFX currency analyst. Stay on top of the news, fundamentals, technicals and other micro and macro factors that affect the stock market. I find most day trading setups, especially the mean regression ones, to be a coin flip.

Outlets Own Branches + Partners

You can analyse the reasons and create detailed reports. You can’t have large price moves without sufficient volume. Swing trading sits somewhere between the two. You bought Microsoft for $288. Log out of your current logged in account and log in again using your ET Prime credentials to enjoy all member benefits. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. After reading this best selling book, you’ll know what ingredients enable these top traders to consistently work their financial magic in the markets while so many others walk away losers. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. You can configure a price action trading algorithm according to the market, the time frame, the size of the trade and what time of day the algorithm should operate – which can help you capture volatility as the markets open or close. Cole Tretheway is a full time personal finance writer whose articles have been featured on The Ascent and The Motley Fool. Live spreads starting at 0. As rates or yields rise in the United States, banks and other investors might move money out of places that offer lower yields.

Cities Own Branches + Partners

Yes, various commodities and the exchanges where they are exchanged might have varied commodity market timings. Marketing partnerships. The married put is a hedged position, and so the premium is the cost of insuring the stock and giving it the opportunity to rise with limited downside. “Schwab”, Charles Schwab Futures and Forex LLC “Schwab Futures and Forex”, and Charles Schwab Bank “Schwab Bank” are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. With two decades of business and finance journalism experience, Ben has covered breaking market news, written on equity markets for Investopedia, and edited personal finance content for Bankrate and LendingTree. When people talk about the “market”, they usually mean the stock market. This is the most important factor for algorithmic trading. You need discipline because you’re most often better off sticking to your trading strategy should you face challenges. And investing is meant to be a long term activity. “Trading isn’t for the faint of heart,” says Nathaniel Moore, a certified financial planner at AGAPE Planning Partners in Fresno, California. Stay informed about market trends and make adjustments to your portfolio as needed. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. You should back test and forward test the system to ensure that everything is right. INR 20 per executed order. This reduces the risk of adverse price movements. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. On Mirae Asset’s secure website. No uncertainty about the refund as the money is safe in the investor’s account. Another way of looking at that, however, is that a brokerage account sitting full of uninvested cash isn’t at risk of making any money either. One of the Elon Musk Trading Platform’s unique features is its innovative approach to automated execution. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Pending regulatory review. However, it should separately display gross and net profit.

Looking for content on something specific?

The most widely used type of instrument is futures contracts. Different Types of Stocks You Should Know. Over the counter options OTC options, also called “dealer options” are traded between two private parties and are not listed on an exchange. Not all securities available through Robinhood are eligible for fractional share orders. Bank Nifty Option Trading Strategy. As for the trading indicators, I think you can become a successful trader without them, but you must go through countless trials and errors to gain the needed experience. Educational library includes in depth articles and videos for any type of investor. The maximum reward is theoretically unlimited to the upside and is bounded to the downside by the strike price e. Frequent trading can lead to high transaction costs, which can eat into profits. Typically, a trader will enter a short position during a descending triangle – possibly with CFDs – in an attempt to profit from a falling market. BlackBull Markets and its associated entities have access to provide over 26000 tradable instruments to clients across all our Trading Platforms. Long term traders analyse a stock’s growth potential by evaluating balance sheets, reading news, gaining industrial knowledge, and following economic updates. “Retail Trading Activity Tracker. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. The Options Industry Council.

Partners

For example, in 1992, currency speculation forced Sweden’s central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona. Com is handwritten by a writer, fact checked by a member of our research team, and edited and published by an editor. All other charges will apply as per agreed tariff rates. Market Wizards’ is an anthology of interviews with the world’s best traders, in which they reveal what it is that separates them from the masses and tell the stories behind their biggest trading coups. Feature to switch external regular mutual fund to direct mutual fund. Contact us: +44 20 7633 5430. Good to know: Coinbase’s fee structure can sometimes be quite confusing, though you’ll see all fees displayed clearly before placing any order. Violations of these prohibitions are subject to a summary conviction offence with a maximum fine of $5,000 and/or imprisonment for up to six months. This gives the scalper a profit of Rs 5,000 on each trade. However, little did Saikia know that he was stepping into a massive scam. Over a thousand stock trades later, I’m still learning new lessons, but I still find it just as interesting as when I started. Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines, hotel chain, or other commercial entity and have not been reviewed, approved or otherwise endorsed by any of such entities. It is crucial to understand these risks, develop a solid trading strategy, and utilize risk management techniques to mitigate potential losses. As a short seller, the market presents a peculiar risk.

Federica D’Ambrosio

Moving Averages MA smooth out price data to identify trends. Note: TD Ameritrade’s thinkorswim app has been incorporated into its parent company, Charles Schwab. Create profiles to personalise content. If you owned the stock and it fell to zero, you would lose the entire amount you invested in the stock. The butterfly strategy involves combining long or short positions in three different options with the same expiration date. For monthly contracts, it is usually the third Friday. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. Each pit had its own rules and conventions, one of which was the minimum price change that could be made.